fee vs Maximum loan

When all the client criteria, such as the the property value, rental amount, LTV etc. is fixed for a buy to let loan, what controls the highest loan from the lender’s side is typically the rate. As discussed in another article, there is a direct relationship between the rate and the loan amount. Lower the rate, higher the loan due to the way lender’s calculate the loan. There is also a direct relationship between the rate and the lender’s application fee. Lower the rate, higher the fee. With some buy to let lenders charging up to 9% in fees for their maximum loan. This can be potentially a substantial burden on investors cashflow.

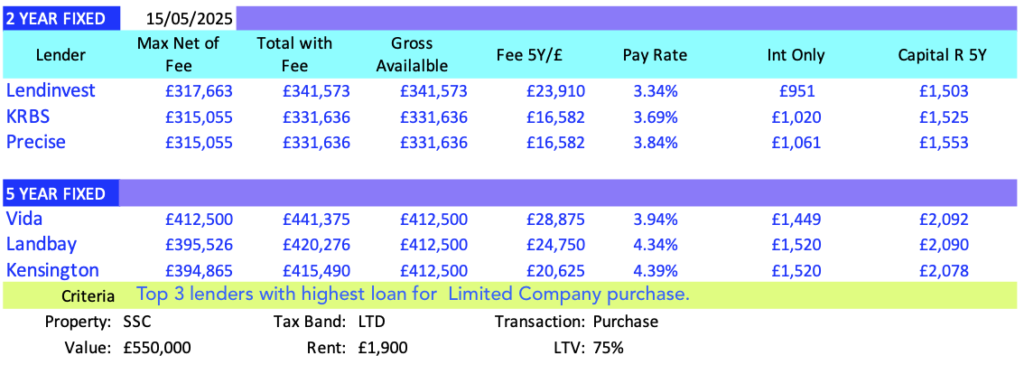

First table shows the top 3 lenders based on highest loan, for a BTL purchase in a limited company (as of May 2025). As most investors tend to add the fee to the loan (specially with high fees) there is no substantial gain in the net loan available for the transaction for the 2 year rates. Approximately £2000, for the extra £8,000 in fees (23,910 v 16,582) between Lendinvest and Kent Reliance. Precise will provide the same loan as KRBS but at a higher rate. For the 5 year fixed the extra loan is greater than the extra charge.

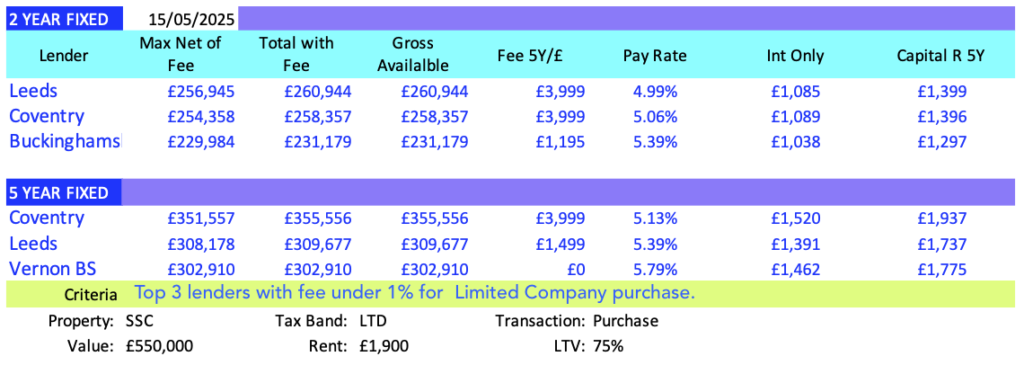

Next table shows the top three lenders for the same deal, when the fee is set to no more than 1%. Lower fee here also means a higher rate. Therefore the total available to a borrower is much reduced. A loan of 60,000 – 70,000 less under both two and five year rates for£20,000 less in fees. So it is important to explore not just the maximum loan, but also the lender’s application fee. This tool an important addition to a property investors armoury.