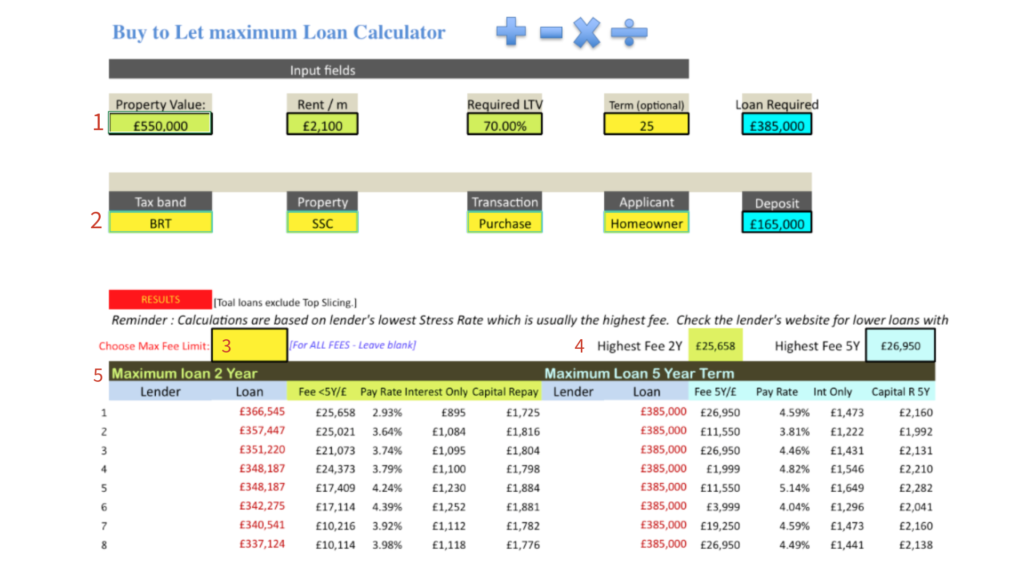

Input your requirements and scroll down for the loan amount.

- Loan Requirement. Input as required Property Value, Rent, Loans to value needed and the term (required for capital repayment calculations).

Section 2: Client Criteria Selection

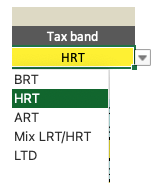

A. Applicant Tax Band – select applicable from drop down.

- BRT – Basic Rate or non tax payer.

- HRT – Higher Rate tax payer.

- Mixed – joint applications with different tax bands. Few lenders distinguish the difference. Majority do not.

- ART – Additional Rate tax payer.

- LTD – purchases under a Limited Company.

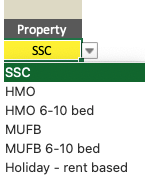

B. Property Type

- SSC – Single Self Contained Unit

- Holiday Let Rent based – Short term lets where the loan is based on rent received.

- HMO – House of multiple occupation up to 6 bedrooms.

- MUFB – Multi Unit Freehold blocks up to 6 units.

- HMO 7 – 10 : House of multiple occupation with 7 to 10 beds.

- MUFB 7 – 10 : Multi unit freehold blocks with 7 to 10 units.

C. Transaction Types

- Purchase: where the transaction is purchase of a new BTL property.

- Let to Buy Resi 2 BTL: this is a remortgage transaction where the home owner wants to let the current property as a buy to let and purchase a new home to reside.

- Remo w Capital: where an existing buy to let property is remortgaged to raise capital. Rates and Rental calculation is same as for purchase.

- Remo £ for £: remortgage without capital raising. Many lenders have reduced ICR and stress rates giving higher loan amounts.

- Remo Bridge B4 6m: Specially useful for auction purchase properties with or without refurbishing. Excludes inherited property.

D. Client Type

- Homeowner : owner occupiers with at least one other BTL property. Owner occupiers purchasing first buy to let, use FTLL option.

- Consumer BTL : also called “accidental” landlords. Owner occupiers who needs to move but cannot sell current property. Some lenders does not allow a BTL remortgage where the applicant has lived.

- Expat: UK resident / citizens living and working abroad.

- FTB : First Time Buyers, applicants who do not currently own any other property, including their own residential. There is only a restricted number of lenders for these clients.

- FTB with HO : joint applications where one applicant is a property owner and the other does not own any other property. Most BTL lenders with treat them as home owner but there are exceptions.

- FTLL : First time landlord. Owner occupier purchasing first BTL property. There are few lenders that only lend to experienced landlords.

- Portfolio LL – eliminates lenders that do not lender to investors with greater than 4 BTL properties.

- Regulated BTL : purchase of a BTL for family member to live.

Advance Functionality with subscription

A: Full Maximum Loan Tool.

B: Individual Lender search.

C. Manual Calculator – Calculate loan for any rate of the lender

In this video we will calculate the loan for a specific rate. The loan required is £170,000 for a higher rate tax payer, purchasing a property of £300,000 with a rent of £1300/m.